consulting

“To improve is to change, to be perfect is to change often.” – Winston Churchill

What

we do

We work with senior leaders of banks, asset managers, and other financial institutions to help them shape and deliver solutions across compliance, governance, risk, regulatory operations and technology.

Using web-based and face to face consulting, with agreed periodic on-site visits by our experienced consultants, we provide clients with regular advice on compliance issues and an opportunity to discuss developments at your firm and any regulatory implications of these changes.

Regulatory training is also provided as required. We provide support that covers training and instruction in the compliance framework and your regulatory obligations; management of regulatory developments and changes as they impact on your firm.

We have experience in providing effective interim cover for senior leadership roles, and are able to bridge urgent gaps and hit the ground running, quickly assessing and addressing urgent issues to provide a seamless transition and support for teams.

Our Expertise

Regulatory risk and compliance

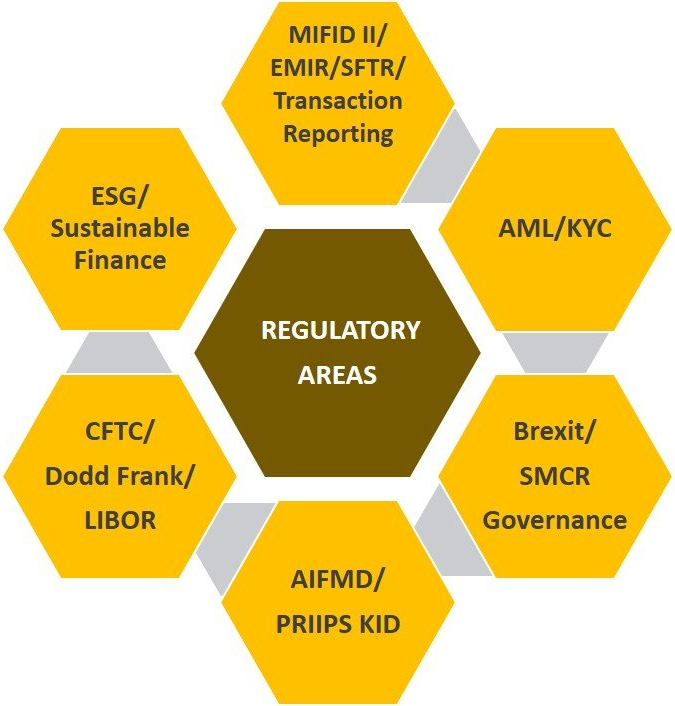

Our consulting team provides an ongoing compliance support service that is customised to your firm’s needs. We are experienced in helping firms to meet their regulatory requirements by installing a compliance framework and governance structure that covers all of the firm’s compliance obligations

Financial Crime front line policy advisory

We provide advice to CEO/COOs on their implementation of policies. We also provide compliance monitoring support that covers related UK FCA regulations like MiFID II, AML - KYC, EMIR, SFTR, MAD MAR, LIBOR and many others. Regular on-site visits by our experienced consultants provide you with regular advice on all operational compliance issues and an opportunity to discuss developments at your firm and any regulatory implications of these policy changes.

Governance & controls design

We assist you in setting up a governance and control framework, which aligns your organisational design with your regulatory obligations under SMCR to demonstrate that you have effective controls, risk oversight, and roles and responsibilities operating effectively.

Regulation interpretation

We support you with the interpretation of local and global regulation impacting your businesses, as well as the management of regulatory developments and changes and their impact on your firm. Regular on-site visits by our experienced consultants provide clients with regular advice on compliance issues and an opportunity to discuss developments at your firm and any regulatory implications of these changes. Regulatory training is also provided as required.

Regulatory implementation

We provide essential operational expertise to enable compliance with regulatory and risk-based obligations, today and in the future.

Process and procedure re-design and training

We review, refine and develop processes and procedures required to ensure your business teams can carry out regulatory obligations effectively. Using web based and face to face consulting, we also provide you with operational compliance support including regulatory training and instruction on the new and existing processes within the regulatory compliance framework at your firm.

Policy and process automation

We provide operational support in ensuring that robust controls are maintained and enabling maximised operational efficiency across key pillars of people, process and automation via technology.

Operational controls and implementation

We are able to deploy a uniquely experienced team who have worked together extensively, to deliver against your mandate. The seamless interplay and understanding of how to leverage our skill sets between our regulatory, operations and change management expertise, along with client relationship and leadership skills, is unique.

“We

cannot

solve our problems with the same thinking we used when we created them.” – Albert Einstein

Change management

Our team will provide immediate, highly skilled interim change management cover for all regulatory projects, to support our clients.

Business optimisation and transformation

We provide support to you in driving, shaping and managing the delivery of critical change programmes, to achieve key strategic objectives, operational optimisation and efficiency.

Remediation implementation

We provide you with help to develop and manage action plans designed to achieve your remediation objectives across operations. This ensure you can demonstrate compliance with your regulatory objectives.

Technology implementation

We help you direct institutional change within your business through implementing new innovative market leading technology solutions. We also provide transition management to integrate new technology enhancements into your existing platforms and infrastructure.

By applying the latest data mining technology, bench marking, peer analysis and management information, we help you understand your competitive landscape and improve your revenue.